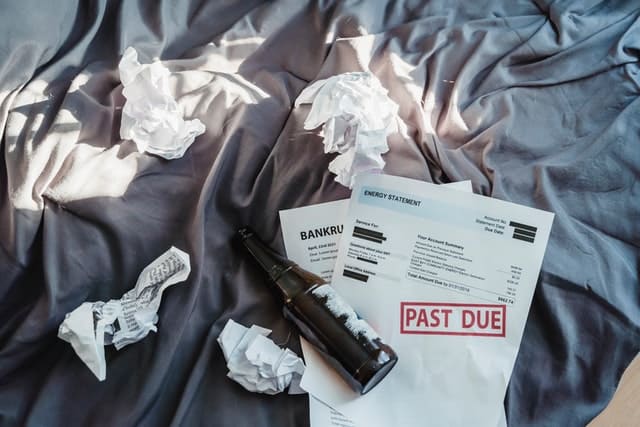

Yes, you can file for bankruptcy on your payday loans, but this should not be your first port of call if you are in excessive debt. Bankruptcy will damage your credit score and mean you may not be able to borrow money again unless you improve your credit score.

Filing For Bankruptcy

Bankruptcy should always be one of your last options when you cannot repay your loans.

While bankruptcy will write off any existing loans that you are unable to pay off, it will also damage your chances of being able to take out a loan ever again.

It is always worth chatting to a financial advisor if you are struggling to repay your loans. If you cannot afford advice, there are charities that offer financial advice for free. A financial advisor will be able to talk to you about your options and advise you on how to navigate your way out of your troubles. If a financial advisor believes bankruptcy is your best option, they will be able to help you through the process.

If you are certain about bankruptcy, you may wish to hire a bankruptcy attorney straight away.

You may wish to seek professional advice before filing for bankruptcy.

What Else Could I Do?

An option to avoid bankruptcy is to make an agreement between you and your lender that interest will be frozen to help minimize how much you need to pay. This will lower your credit score but it has less stigma attached than bankruptcy.

What Should I Do If I Cannot Repay My Loans?

The first thing you should do is contact your lender. Lenders will do their best to ensure that you can repay your loan, so if you find yourself at a loose end, contact your lender first.

You could file bankruptcy. Claiming bankruptcy should not be taken lightly and should be talked over with a professional.

Being unable to repay a loan can be terrifying. In situations like this, it is advisable to seek advice from a nonprofit credit counsellor, bankruptcy attorney or legal aid centre about your next moves.

What If I Just Don’t Pay?

Defaulting on your payday loan can drain your bank account, lead to wage garnishment, collection calls or, in extreme situations, lawsuits. Wherever possible, keep up with your repayments to avoid these outcomes.

Once the agreed loan period has passed the lender who you borrowed from will continue to seek any unpaid amount on your loan. The lender will set up automatic withdrawals from your account, attempting to regain as much for their loan as possible. This can result in bank fees for you. If this is unsuccessful your lender may begin collection calls, which will involve calling you and in some cases visiting you in person to attempt to collect the debt.

If this is unsuccessful, your lender may set up wage garnishment, which involves a part of your paycheck being withheld, and going directly to the lender to repay your loan.

Over the time that you don’t pay your debt back, it will accumulate interest that you will need to pay. Therefore, the longer you leave it, the more expensive it is for you.

The longer you leave your debts unpaid, the more interest they will accumulate, which you will need to pay off.

Could I Go To Court?

Yes. This will always be a last resort and in the vast majority of cases the court does not need to be involved.

Court cases are not always about large sums of money. It is common for a lender to take a client to court over a relatively small unpaid loan. You should not be surprised if you receive a lawsuit following an unpaid payday loan.