Yes! Almost anyone, including retirees, can qualify for a secured or unsecured short-term loan. In the US, 66.9% of 65-74 year olds are retired as of Q3 2021.

The payday most retirees enjoy is a monthly Social Security check, and that’s what’s borrowed against. Even if you’re eligible, you should only seek a payday loan in the event of an emergency and if you’re sure you’ll pay it back. Failing to repay your loan can result in additional fees and damage to your credit record.

Key Points:

- It is possible for retirees to get a payday loan, despite not being employed.

- Retirees may need loans to cover costs such as medical bills and dental care.

- Other means of financing for retired individuals include Social Security benefits, which are available to those over the age of 65. Over 90% of those in this age bracket claim this support.

- Other financial help options for retirees include Supplementary Accommodation Benefits.

Can I Get A Payday Loan as A Retiree?

Yes! Payday loans can provide assistance for the over-75 age category, and plenty of borrowers are part of this age bracket.

Retirees are typically over 65 and therefore encounter more frequent medical or dental bills. These all come at a cost, and can sometimes be surprisingly high. It’s at times like these you may need to reach out for help. Don’t be embarrassed, you are one of 12 million American annual payday loan borrowers.

If borrowers, including retirees, meet the loan requirements and verify their source of income, they can be approved on the same day.

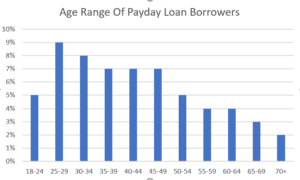

People of all age groups use payday loans across the US.

Why Would I Need a Loan as A Retiree?

As we age, sometimes there can be more check-ups and bills that need covering.

Maybe you need to cover a medical bill, maybe your dog needs surgery, or maybe your boiler has broken and you need it fixed as soon as possible.

That’s where loans can help! Due to their rapid nature and ease, they are often the most suitable solution, especially when you are retired, given that you can’t ask an employer for a cash advance, or simply know you have your payday coming soon. In some cases you can even get a same day loan.

Am I Eligible For A Payday Loan?

As a retiree, you are beyond the minimum age requirement of 18.

The basic criteria includes but is not exclusive to:

- You must be a legal US citizen.

- Have valid ID.

- You must have a valid current/checking account, for your loan to be paid into.

- Have some form of monthly income (this can be government support, as is the norm for retirees).

You will be asked to provide this information when you apply for a payday loan. These requirements will differ from lender to lender, but will vaguely resemble these.

But I Have Bad Credit. Can I Still Be Approved?

Yes. A low credit score does not stop you from securing a payday loan.

A credit score is a number between 300 and 850 and reflects how reliable a borrower you have been in the past. The higher your score, the better, as this indicates that you have paid off bills and debts promptly and fully previously.

If you have credit below around 580, you may wish to apply for a no-credit check loan. This simply means that your lender does not base their lending on borrowers’ credit scores, and therefore your credit history is not a factor.

Payday loans are legal in 37 US states, such as California, Texas and North Carolina.

Other Financial Options For Over-75s

Social Security

This is a method of helping retirees with their cost of living, but shouldn’t be used as the main source of income for retirees. Over 90% of American adults over f 65 receive Social Security benefits.

Citizens over 65 are also entitled to Supplemental Security Income, which bolsters the amount from Social Security. This is only if they can verify that they have disabilities and access only to limited resources.

Government Programs

Specific programs such as the Supplementary Accommodation Benefit provide support to eligible seniors who have a low income and are living in designated care residencies.

Programs such as the Housing and Urban Development helps low-income seniors to meet mortgage payments. Similarly, the USDA helps with housing repair credit and grants at a low-level fixed income rate. The Low Income Home Energy Assistance Program (LIHEAP) helps low-income seniors manage the cost of their home energy bills.

Healthcare Support

If your financial hardship is healthcare-related, the government will often try to help you to get on-top of it. It is reported that seven million elderly Americans have problems paying their medical bills.